As we all know, the Social Security tax was reduced by 2% for 2011 from 6.2% to 4.2% of salaries up to $106,800. This tax is usually combined with the 1.45% Medicare tax into what is traditionally called FICA. For all employee withholding for the year, you should reduce your FICA amount by 2% from the usual 7.65% to 5.65%.

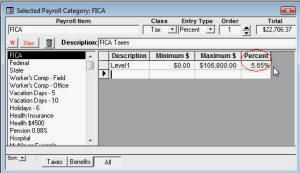

If you use Numbers Cruncher for calculating your breakeven and profitable selling price, be sure to make this adjustment on the Tax/Benefit form. You can reduce the FICA percentage to 5.65% for 2011. Numbers Cruncher will adjust all of your employees’ salary numbers, your breakeven and your profitable selling price automatically.

If you use Numbers Cruncher for calculating your breakeven and profitable selling price, be sure to make this adjustment on the Tax/Benefit form. You can reduce the FICA percentage to 5.65% for 2011. Numbers Cruncher will adjust all of your employees’ salary numbers, your breakeven and your profitable selling price automatically.

You can see a quick summary of the change on the IRS site. You should consult with your accountant to be sure you get this right.