These days it seems like there are dozens of companies that want to integrate your flat rate prices into their systems. There is one glaring flaw in almost all of these systems, they don’t know how Flat Rate Pricing actually works. They don’t know how to generate profitable pricing, and they don’t understand the value of having a flat rate system that can be updated properly.

These days it seems like there are dozens of companies that want to integrate your flat rate prices into their systems. There is one glaring flaw in almost all of these systems, they don’t know how Flat Rate Pricing actually works. They don’t know how to generate profitable pricing, and they don’t understand the value of having a flat rate system that can be updated properly.

The most flexible of these new systems allow you to update you prices by some fixed percentage. This is quick and easy, but updating prices that are probably incorrect already with an arbitrary percentage is a sure way to lose money and customers.

One of the problems with many popular integrated systems that include flat rate modules don’t really work the way they should because many systems ignore the fundamental information needed to create profitable pricing. This may seem to be a pretty strong statement considering the wide adoption of these new flat rate systems throughout our industries. So let’s look at just one small part of service pricing to illustrate how most of the menu pricing systems ignore the basic price calculations used in setting Flat Rate prices.

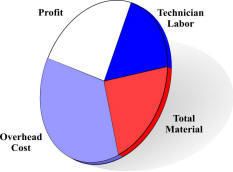

Flat Rate is made up of averaged values for time, materials, and profit for the standard jobs that you do. The easiest part of this to quantify and control is materials. You know with certainty what parts you will use on a job, and what they cost. And yet, we see questions about material pricing, specifically Markup, on a regular basis. Here’s our answer to questions about how to markup your materials.

If you want to have a consistently profitable price system, you do not want to use material markup. It only complicates the entire process, and can often lead to over and under charging.

These questions about material markup stem from a basic misunderstanding of Flat Rate that is spread by many modern business system providers.

Flat Rate was developed to make business pricing simpler, easier to use, and better at closing the sale. The simpler part means that your pricing is directly related to what your business brings to the table – time and expertise. In Flat Rate, you make your money for your time sold. Material markup is an obsolete tool left over from the T&M days when it was used to hide how much you charged per hour. If your material costs appeared high enough, you could lower the hourly amount you charged for your time on the job.

Providing service is expensive. The overhead and labor costs included in the job time has always been more than consumers could be comfortable with. Flat rate removes the cost breakout information from the transaction, so you can charge for your services based on your actual costs and skill. This means that marking up materials is a waste of time and effort.

Providing service is expensive. The overhead and labor costs included in the job time has always been more than consumers could be comfortable with. Flat rate removes the cost breakout information from the transaction, so you can charge for your services based on your actual costs and skill. This means that marking up materials is a waste of time and effort.

Let’s look at a simple example. Many systems recommend that you mark up parts that cost less than $10 by as much as 300% or more. Before modern flat rate, this amount was chosen to help inflate the underlying cost for small jobs. The inflated material cost helped to lower the hourly labor rate you had to charge in the T&M system. But, what happens if you have a job that will use 10, 20 or even 50 of a part that you have marked up by 300%? Your pricing will be too high, and you risk losing the job.

The solution is to not mark up any of your materials unless there is a specific need for a specific part. This makes setting your flat rate prices much, much simpler, and more reliably profitable. This means that your selling prices are dependent just on your cost for doing the work, and the profit you want to earn. Small jobs won’t be overpriced by ridiculous markups, and large jobs won’t be under-priced by too low hourly rates.

The added bonus is that this makes setting up and maintaining your flat rate prices much simpler. Material costs are just your material costs –no extra calculations, no extra decisions, no extra adjustments.

We often get asked the question, “Why shouldn’t we earn profit on materials”?

The answer is very simple, “Of course you are earning profit on materials”. With Flat Rate, the same profit target you earn on labor, overhead, and everything that is a cost to your company is automatically included in the task. Your earn a profit on every part you sell.

When your cost for overhead or labor changes, you can adjust all of your prices by entering just a couple of numbers. This is how Flat Rate Pricing was originally designed to work, and this is how it works best now. Keep it simple for the office, for the tech, for the customer. That’s how Flat Rate is supposed to work.

Successful service business set their Profit target first, and know their Breakeven cost including target Key Performance Indicators (KPI) that can be measured and adjusted. This makes keeping your prices at a profitable level a simple, orderly process.

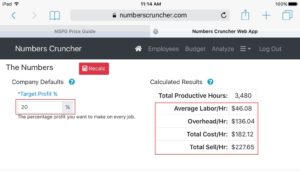

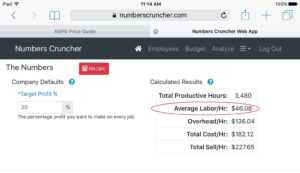

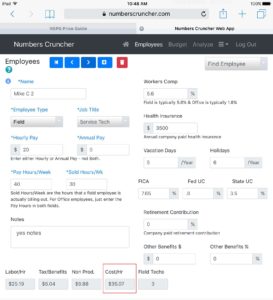

If you can import your flat rate pricing into your modern integrated business solution, you need to create your flat rate prices using software that actually uses your basic cost information. Then, send the properly configured pricing to your chosen integrated system. This will allow you to manage your prices properly while having all the bells and whistles your business may need.

The NSPG Flat Rate Price Guide supports dozens of integrated systems and accounting packages. Give us a call if you need some guidance on setting and maintaining your own profitable prices.

Unless you recently crunched your numbers, updated your price delivery system, and retrained your employees, the prices that you are offering to your customers are wrong. It’s an inescapable fact that without some real effort, your prices will not reflect your actual costs. Having that fancy new tablet app u

Unless you recently crunched your numbers, updated your price delivery system, and retrained your employees, the prices that you are offering to your customers are wrong. It’s an inescapable fact that without some real effort, your prices will not reflect your actual costs. Having that fancy new tablet app u Implementing these new price delivery techniques has never been easier or faster with NSPG Price Guides, and is now available with the Price Guide mobile web app. The added advantage of built in inspection forms in the NSPG Web App makes add on sales easier for even the most reluctant field techs.

Implementing these new price delivery techniques has never been easier or faster with NSPG Price Guides, and is now available with the Price Guide mobile web app. The added advantage of built in inspection forms in the NSPG Web App makes add on sales easier for even the most reluctant field techs.

Would losing your client list or accounting data cause you major headaches?

Would losing your client list or accounting data cause you major headaches? Microsoft prefers that you go with Windows 8. It’s faster and more secure, and it has the tile menu system that most people seem to hate. Windows 8.1 has made improvements, but there is still no Start menu. This means that XP users may be confused about how to get some things done. You can easily find Windows 8 computers, and all will automatically upgrade to Windows 8.1.

Microsoft prefers that you go with Windows 8. It’s faster and more secure, and it has the tile menu system that most people seem to hate. Windows 8.1 has made improvements, but there is still no Start menu. This means that XP users may be confused about how to get some things done. You can easily find Windows 8 computers, and all will automatically upgrade to Windows 8.1. Make sure that all of your installed software is up to date. Security updates, especially Adobe Acrobat and Java, MUST be installed as soon as they become available.

Make sure that all of your installed software is up to date. Security updates, especially Adobe Acrobat and Java, MUST be installed as soon as they become available. First, write down everything you’d like to accomplish. Don’t worry about the details, just consider the goal itself. Once you have the list, read each item out loud to yourself. As you read each item, decide if it still seems important among all the other items you have listed. If not, cross it off. Depending on the length of the list, you may need to repeat this process until you winnow the tasks down to just the most important ones.

First, write down everything you’d like to accomplish. Don’t worry about the details, just consider the goal itself. Once you have the list, read each item out loud to yourself. As you read each item, decide if it still seems important among all the other items you have listed. If not, cross it off. Depending on the length of the list, you may need to repeat this process until you winnow the tasks down to just the most important ones. Focusing on your real priorities will keep you from planning to do everything while accomplishing nothing. You will get more done, and feel less overwhelmed by the seemingly endless list of things you’d like to accomplish.

Focusing on your real priorities will keep you from planning to do everything while accomplishing nothing. You will get more done, and feel less overwhelmed by the seemingly endless list of things you’d like to accomplish.