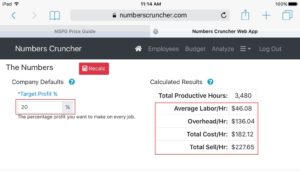

To set your profitable selling price, you need to know four numbers about your business: Labor Rate, Overhead Rate, Productive Hours, and Target Profit %.

In our previous article, we explained how to calculate your profitable Field Labor Rate. In this article, we will take a look at your Overhead Rate, Productive Hours, Profit Percentage, and put it all together to establish a consistently profitable selling price.

This article is a bit technical, but it will only take a few minutes to read. Invest a few minutes so that you will have a better understanding of how to make your business run better.

Overhead

Overhead

Your Overhead Rate includes all of your expenses except your Field Labor. This includes things like vehicles, office rent, advertising, tools, office salaries, etc.

Your business’ Overhead can be easy to determine, but often it is harder than it should be. If you have a good accountant, he may be able to generate a report for you that lists everything you need. If you use an accounting program (if you have it set up right, and if you know how to use it) you can generate your own report that will list and total all of your costs. Otherwise, start with your business checkbook and credit card statements and using pencil and paper, a spreadsheet program , or a dedicated program like Numbers Cruncher, and add up all of your expenses. This total is your Overhead cost.

The time period you use for each entry should be selected so you are sure to capture all of your costs. Some costs, like insurance and membership dues, may only happen once a year, so don’t forget them.

Total Productive Hours

Productive hours were mentioned briefly in our previous article. In order to set your profitable Sell Price, you will need to total up all the hours for all your field employees that were billed during your selected time period. This is your Total Productive Hours. This number can be difficult to accurately establish and project into the future. It is critical that you get as close to the actual number as possible because your profitability depends on it.

If you use time cards, this could be an easy task. If your invoices include a billed time factor, review them, and add up the hours billed. If you are using a Flat Rate system, your Tasks should have a time factor built into them to show the amount of time allotted to each job.

Remember that Productive hours are the hours you actually bill to a customer. They are NOT the numbers of hours you pay your field employees. If you are doing service work, it’s just about impossible to bill 40 hours in a 40 hour week. Most well run companies bill between 20 and 25 hours in a 40 hour week. Installs can be higher, but Service is inherently less efficient.

For example, a single employee who is productive (Bills out) 20 hours/week.

20 Hrs/Wk X 52 Weeks/Year = 1,040 Hrs/Year

Breakeven

Your Breakeven is your Total Cost/Hr which is made up of your Field Labor/Hr plus your Overhead/Hr. This is what it costs to run your business for the specified time period.

Your Breakeven Cost per Hour is calculated by dividing your Total Business Costs by your Total Productive Hours.

Breakeven = Total Business Costs ÷ Total Productive Hours

If you charge this amount, you will not lose money, but you will also not make any profit. You need to add Profit to the calculation. Your business must consistently make a profit, or it will eventually fail.

Profit Percentage

The final piece of information in establishing your Selling Price is your Target Profit Percentage. This is the percentage of each job that you sell that will be profit for your business. Some service businesses try to compete on price by keeping their profits low. This can work to keep your employees busy, but almost always leads to a failed business. Without a decent profit, your business will not survive.

You must choose a Profit Percentage that works for your business. Do not use a number that someone tells you is the “Right” number. For most service businesses there is an accepted range for Profit Percentage, but only you should set this number for your business.

Selling Price

To set your Selling Price (Total Sell/Hr), you need to add your profit to your Breakeven (Total Cost/Hour).

Selling Price = Breakeven ÷ (1 – Profit%)

For example, taket a company with a Breakeven of $200.00/hr and a profit target of 20%.

Selling Price = $200 ÷ (1 – 0.20) = $250.00

This would yield a 20% profit of $50 per productive hour.

You should check and adjust your Selling Price on a regular basis. Your costs and productivity change regularly, so you need to be sure that your Selling Price continues to yield the profit you expect. This is why you need to be able to quickly check and adjust the four numbers that make up your Selling Price.

Whatever tool you use for this process, you should recalculate your numbers and update your Sell Prices multiple times per year. A spreadsheet, or a dedicated program like Numbers Cruncher makes this easier and less time consuming. Once you have the new profitable numbers, you should update your price books (paper or app), and get them out to the field as quickly as possible.

Please use your own numbers and not these examples.

Whether you use a spreadsheet, pencil and paper, or Numbers Cruncher, you MUST accurately set your own selling price. Understanding how it works will allow you to make the right decisions on setting your prices at a level that covers your costs and earns you the profit you need to stay in business and serving your customers.