|

NSPG

Monthly E-Newsletter

|

||

|

|||

|

In 1992,

NSPG

released Numbers Cruncher, our Break Even Calculator.

This was followed by our Flat Rate Price Book product

line. With our

simple-to-use-tools, you can make being a business owner

what you always wanted to it be -

successful, profitable and rewarding.

Intelligent Pricing

Breakeven Cost Per

Hour

1. Overhead plus Labor

cost = Total Business Costs Total Business Costs can be easy to determine, but often it is harder than it should be. If you have a good accountant, he may be able to generate a report for you that lists everything you need. Or, if you use an accounting program (if you have it set up right, and if you know how to do it) you can generate your own report that will list and total all of your costs. Otherwise, start with your business checkbook and - using pencil and paper or a spreadsheet program - manually add up all of your expenses. This total is your Overhead cost. The time period you use should be selected so you are sure to capture all of your costs. Some costs, like insurance and membership dues, may only happen once a year, so don't forget them. For Numbers Cruncher users, this the process of finding your Overhead that happens when you fill in the Budget form. Next, total up all of your field employee costs. This includes salaries, benefits, taxes, bonuses, etc. Add this number to your Overhead costs to get the Total Business Cost.

Here's how you get your Breakeven Cost per Hour from the Total Business Costs and Productive hours that you calculated using the methods mentioned above. Divide your Total Business Costs by your Total Productive Hours to get your Breakeven Cost per Hour. Breakeven = Total Business Costs ÷ Total Productive Hours Remember that Productive hours are the hours you actually bill to a customer. They are NOT the numbers of hours you pay your field employees for. If you are doing service work, it's just about impossible to bill 40 hours in a 40 hour week. Most well run companies bill between 20 and 25 hours in a 40 hour week.

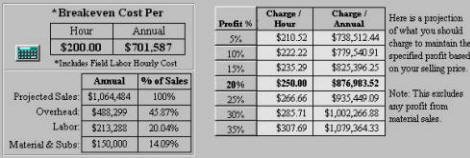

Set Your Selling

Price Selling Price = Breakeven ÷ (1 - Profit%) Let's say your Breakeven is $200.00/hr and your profit target is 20% (see Numbers Cruncher example below). Here's how the Selling Price calculation would look: Selling Price = $200 ÷ (1 - 0.20) = $250.00 This would yield a 20% profit of $50 per productive hour. You should check and adjust this number on a regular basis. Your costs change regularly, so you need to be sure that your Selling Price continues to yield the profit you expect.

Whether you use a spreadsheet, pencil and paper, or Numbers Cruncher, you MUST accurately set your own selling price. Understanding how it works will allow you to make the right decisions on setting your prices at a level that covers your costs and earns you the profit you need to stay in business and serving your customers.

Most of us can easily recognize the circumstances where you need to lower your profit percentage to be competitive. Creating a "loss leader" to get in the door for a low skill, high competition service can be a good business decision. As long as you continue to communicate with your customer list, a low profit initial sale can lead to a long term relationship with the customer. The flip side of this scenario is the rare occasion in which you are able to earn a slightly higher profit on a job because of your specific market and the nature of the service. For example, installing a new technology energy saving device that requires extra skill and knowledge may earn you a higher profit percentage than a standard product. Earning a bit more for the skill required and the job complexity is only reasonable. Choosing a higher profit percentage for these jobs provides the extra profits you need to continue your training efforts that allow you to handle the latest technologies. Accurately calculating your break even, and accurately calculating your selling price on a quarterly basis will assure that you remain profitable. As your Business Costs and your Total Productive Hours change, you must reset your selling prices. In today's fast moving economy, you should recalculate your numbers on a quarterly basis. Some companies even make adjustments monthly. Choose how often you need to reset your prices, and stick to it. A few dollars lost on each job ticket can add up to a losing year. NSPG software tools can help you quantify what it costs to run your own successful business. Knowing your numbers so you can properly price and sell your services is critical if you are going to build your own profitable, high quality business.

- - - - - - - Give Mike Conroy a call to discuss motivating your employees, creating your own market niche, selective discounts, loss leaders, your numbers, your performance benchmarks, or your flat rate books. Take advantage of his experience working with hundreds of companies like yours to help you achieve your own business success.

Measure Monthly, Adjust Quarterly

Industry suppliers continue to announce price increases for a broad range of product lines. Latest increases we have seen range from five to six percent.

Interesting

Online Items Freakonomics of Service Warranties Electrician's Green Opportunities

Call 800 841-8542 today |

|

|

Nexstar members answer that question two ways:

Real contractors. Real results.Others make similar claims. Here's the difference: Members. They own Nexstar. We talk, build a knowledge base of what works and doesn't work, cut out the pitchmen and consult with the real deal experts in fields that matter to members. No gimmicks. No "pre-fab" systems. And no policy requirements that commit you long term. We know your world and speak your language because our members are your peers.

1-888-609-5490

— Connects you to a huge pool of knowledge and

experience. NEW! FREE on-line business assessment. Discover business areas that you need to improve to make your business better.

|

|

Click a product for more information: Numbers Cruncher - Breakeven Calculator, Performance Monitor National Standard Price Guide - Flat Rate Price Books Performance Dispatch Plus - Dispatch, Benchmarks, Flat Rate, Invoice, QuickBooks |

|

|

|

|

|

|

||

|

Ever Wonder Where Did the Money Go? |

|

|

|

||

| Call 800-841-8542 now so we can answer your questions and show how we can help you build a more profitable business. | ||

NSPG, Inc. PO Box 1168, Manahawkin, NJ 08050

800-841-8542

201-767-5520

To opt out of NSPG mailings, reply to this message with the word REMOVE in the Subject line.

In

this post, we'll review some of the basics of

calculating your breakeven, and then take a look at

adjusting your price to meet market conditions.

Even though Numbers Cruncher users get these numbers

automatically, it never hurts to review the basic

concepts.

In

this post, we'll review some of the basics of

calculating your breakeven, and then take a look at

adjusting your price to meet market conditions.

Even though Numbers Cruncher users get these numbers

automatically, it never hurts to review the basic

concepts. Next you will need to

total up all the hours for your field employees that

were billed during that time period. This is your

Total Productive Hours. If you use

time cards, this could be an easy task. Or, if

your invoices include a billed time factor, review

them, and add up the hours billed. If you are using

NSPG Flat Rate, your Tasks have a time factor built into

them, so your invoices will allow you to know the amount

of time billed on each job.

Next you will need to

total up all the hours for your field employees that

were billed during that time period. This is your

Total Productive Hours. If you use

time cards, this could be an easy task. Or, if

your invoices include a billed time factor, review

them, and add up the hours billed. If you are using

NSPG Flat Rate, your Tasks have a time factor built into

them, so your invoices will allow you to know the amount

of time billed on each job.

For

almost all of your services, the Selling Price you

calculate will work for you. Depending on your

particular market, some jobs could be priced to earn a

higher or lower profit.

For

almost all of your services, the Selling Price you

calculate will work for you. Depending on your

particular market, some jobs could be priced to earn a

higher or lower profit.