Before you can run a profitable business, you need to know what to charge. Matching what a competitor charges, or just picking a number that feels right is a sure way to lose money and customers. Based on our years of experience helping companies calculate their own profitable prices, we know that it is critical that you actually review your own business’ numbers if you want to be successful.

This article is a bit technical, but it will only take about 5 minutes to read. Invest a few minutes so that you will have a better understanding of how to make your business run better.

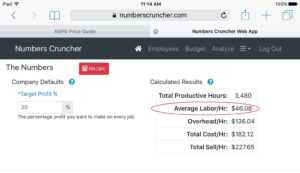

In order to to set your profitable selling price, you need to know four numbers: Labor Rate, Overhead Rate, Productive Hours, and Target Profit %. In this article, we will take a look at how to calculate your actual Labor Rate for your field employees.

Your field Labor Rate includes three components:

- The actual field employee Labor Cost/Hour.

- Company paid taxes and benefits like worker’s comp and FICA taxes.

- The productive hours sold.

Collecting most of this information is relatively easy for most companies since these numbers tend to be spelled out on each field employee’s paycheck stub.

Organizing and calculating these numbers can be done using pencil and paper, a spreadsheet, or a dedicated program like Numbers Cruncher. Whatever tool you choose for this task, the process is basically the same. It just gets easier and potentially more accurate as you progress from pencil and paper to spreadsheet to dedicated software. Ease of use is important since you should be recalculating these numbers on a regular basis.

Field Labor/Hr

Field Labor/Hr

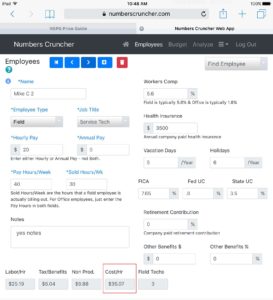

The employee pay component is easy to understand and work with. For hourly employees, take the hourly pay amount, and multiply it by paid hours per week, and then multiply by 52 weeks to get the annual field employee pay. Repeat this for each hourly field employee.

For salaried field employees, this amount is even simpler. It’s just the total Annual Salary excluding company paid taxes/benefits. No multiplication is required.

Company Paid Taxes/Benefits

Taxes and Benefits that the company pays for also contribute to the cost of Field Labor. Items like Worker’s Comp, FICA and Unemployment Insurance, Health Insurance, and any other tax or benefit that the company pays for. This calculation does not include income tax, employee FICA, and other deductions that employees pay for out of their salary.

To complete this calculation for an employee, Vacation and Holidays should be converted to their dollar values both for lost productivity and dollar cost.

Productive Hours

Since your field employees are probably not working on a billed customer job for every hour that you are paying them, you need to account for their unproductive time. Unproductive time can include things like time spent stocking a truck, office meetings, lunch, etc.

The cost to the company for the unproductive time must be spread over the hours that you are actually billing out to customers, or you will lose money. This is done by creating a ratio of the field employee’s Sold Hours divided by their actual Paid Hours.

For example, let’s take a look at a field employee who is paid for 40 hours per week and bills out 30 hours per week. In this example, the Productive Hours are 30. The actual values for the week will be adjusted using the ratio of 40 hours divided by 30 hours. This will increase the Labor Rate so that all of the employee’s labor costs are paid for in the 30 Productive Hours sold each week.

These calculations are simple but time consuming when done on paper, easier when done in a spreadsheet, and are usually done automatically in dedicated apps. Once you set them up, it is easy to update the numbers so that you can be more consistently profitable.

To protect their profitability, the most successful companies review these numbers on a monthly basis. The factors that make up your Field Labor Costs, especially Productive Hours, will change frequently. If you don’t stay on top of it, you could be losing money on every job.

Taking the time to properly set up these calculations so you know what your profitable Labor Sell Price is always accurate will more than pay for itself over time.

Our next article will go into your Overhead Rate, Profit Percentage, and putting it all together to establish a consistently profitable selling price.